The 13 Business FAQs That Will Make Your Company Succeed or Fail

By Kyle D. Winey, Esq. and H. Robert Showers, Esq.

(SS Quarterly 2017 — 4th Quarter)

Small business owners and entrepreneurs embrace their new venture with a sense of optimism and hope. And why not? Without believing in a successful future, there is no reason to start a business in the first place.

This optimistic hope, however, frequently blinds small business owners and entrepreneurs to important legal and business considerations. For better or worse, the business lifecycle is not always a smooth one. That means businesses can and should expect a degree of turbulence.

Fortunately, with the proper planning, small bumps in the road can remain just that: small bumps. But the flip side is also true. Without the proper legal infrastructure in place, bad things can and will strike. As Winston Churchill said, “He who fails to plan is planning to fail.” Some of these problems are reversible, many are not.

Below are thirteen questions that every small business owner and entrepreneur should resolve before beginning.

Economic Considerations

- How is the equity split among partners (e.g. 50/50, 60/40)?

- How are profits and losses shared? (e.g. percentage of ownership interest, equally)?

- What happens if a person leaves the company (e.g. vesting schedules)?

- Will any of us be investing cash in the company? If so, how is this to be treated (e.g. debt, convertible debt, different class of shares)?

- What will we pay ourselves (e.g. salary, distribution)?

- What are the financing plans for the company (e.g. bootstrapping, self-funded, outside investment)?

- What is our 3-year budget (e.g. big expenditures)?

Governance Considerations

- How will decisions be made (e.g. percentage of ownership interest, equal voting rights)?

- Can any of us be fired (e.g. by whom, for what reasons)?

- What contractual terms will each of us sign with the company (e.g. non-compete, non-solicitation)?

Business Strategies

- What are our personal goals of the startup (e.g. acquisition, bootstrap, cash cow)?

- Will this be the primary activity for each of us (e.g. other employment, work allocation)?

- What part of our plan are we each unwilling to change (e.g. core business vs. ancillary)?

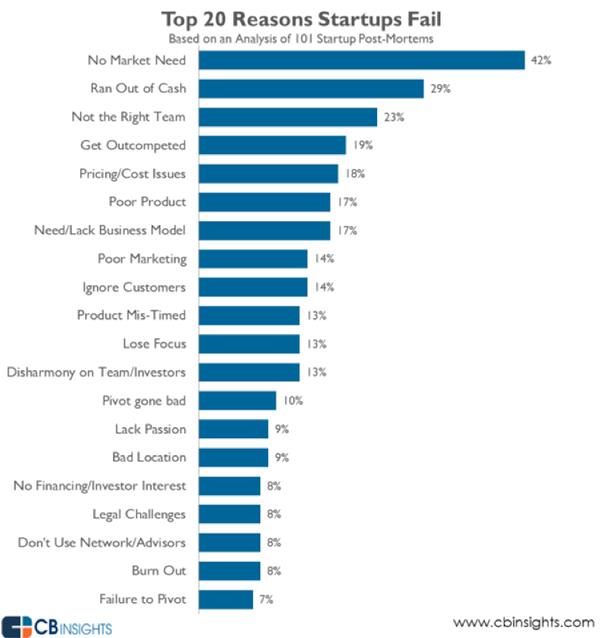

Top Four Reasons Start up Businesses Fail.

While we should observe and learn from the top 20 reasons start -ups fail outlined below, we should also focus on the top four main reasons start -up businesses fail. However, all of the twenty below go to proper structure, business plan and people.

- No market need or not readily ascertainable

Often we have a good idea but we never did the market research to make sure that the demand exists for the business to exist, grow, and succeed. If there is no demand or we do not know how to create demand, then no amount of marketing or creative talent will solve this.

- Undercapitalized

This can happen in three ways:

- You didn’t raise enough cash to begin with;

- The results you expected didn’t happen before you ran out of cash; or

- You scaled prematurely without the reserve or cash flow to maintain the business.

The whole point of the start-up phase is to test and gain clarity in a new unknown area, while keeping expenses as low as possible so you can still be in the game when you can execute the clarity you gained. You don’t want to run out of cash before you can fully execute what you have learned in the startup phase.

- Having the wrong people on the bus or having the wrong people in the right seats on the bus.

While ideas and process are great, having the right people in the right positions is often the difference between success and failure. You may be able to train them +/- 5 to 10% in either direction but you cannot fundamentally change a person. Getting the correct people that naturally exhibit the personality traits and the right skill set with similar values for the success in the role is the only way to create a great team. These sorts of teams create 1000% returns with much less effort.

- Wrong corporate structure and wrong legal protections and documents.

For example, should we create an LLC, C Corporation or S corporation? How should the ownership, management, tax treatment and exit strategy be for the new organization?

In sum, without answering these 13 basic questions, small (inevitable) problems are almost certain to become major barriers to business success. Without addressing these 20 reasons that start-ups fail, you may become one of the statistics that show that 4 out of 5 for-profit or nonprofit start-ups fail in the first 3-5 years. At least let’s focus on the top four to be successful.

Fortunately, it does not need to be this way. Without getting the right corporate and tax structure and right documents, you will stumble and ultimately fail. However, by tackling these common problems at the beginning, entrepreneurs and small business owners can minimize downside risk while maximizing upside gain. Since we have helped hundreds of for-profit and nonprofit start-ups over the years, there is “not much new under the sun” to us and we can help you think through the right business plan, funding, and correct structures and contracts.

******************************************************************************

Disclaimer: This memorandum is provided for general information purposes only and is not a substitute for legal advice particular to your situation. No recipients of this memo should act or refrain from acting solely on the basis of this memorandum without seeking professional legal counsel. Simms Showers, LLP expressly disclaims all liability relating to actions taken or not taken based solely on the content of this memorandum. Please contact Robert Showers, Esq. or Kyle Winey at kdw@simmsshowerslaw.com or 703.771.4671 for legal advice that will meet your specific needs.